Credit Card Fraud Analyst Resume

Make sure to add requirements benefits and perks specific to the role and your company.

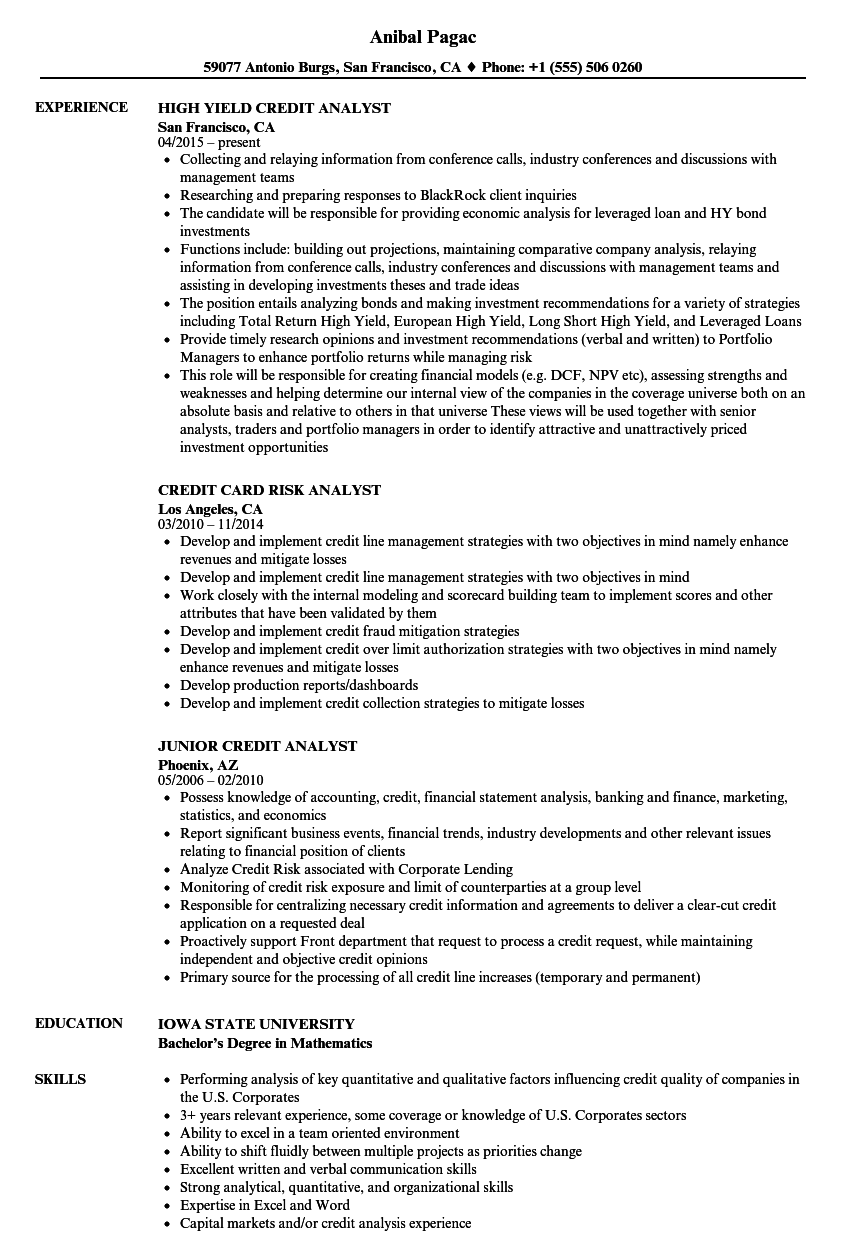

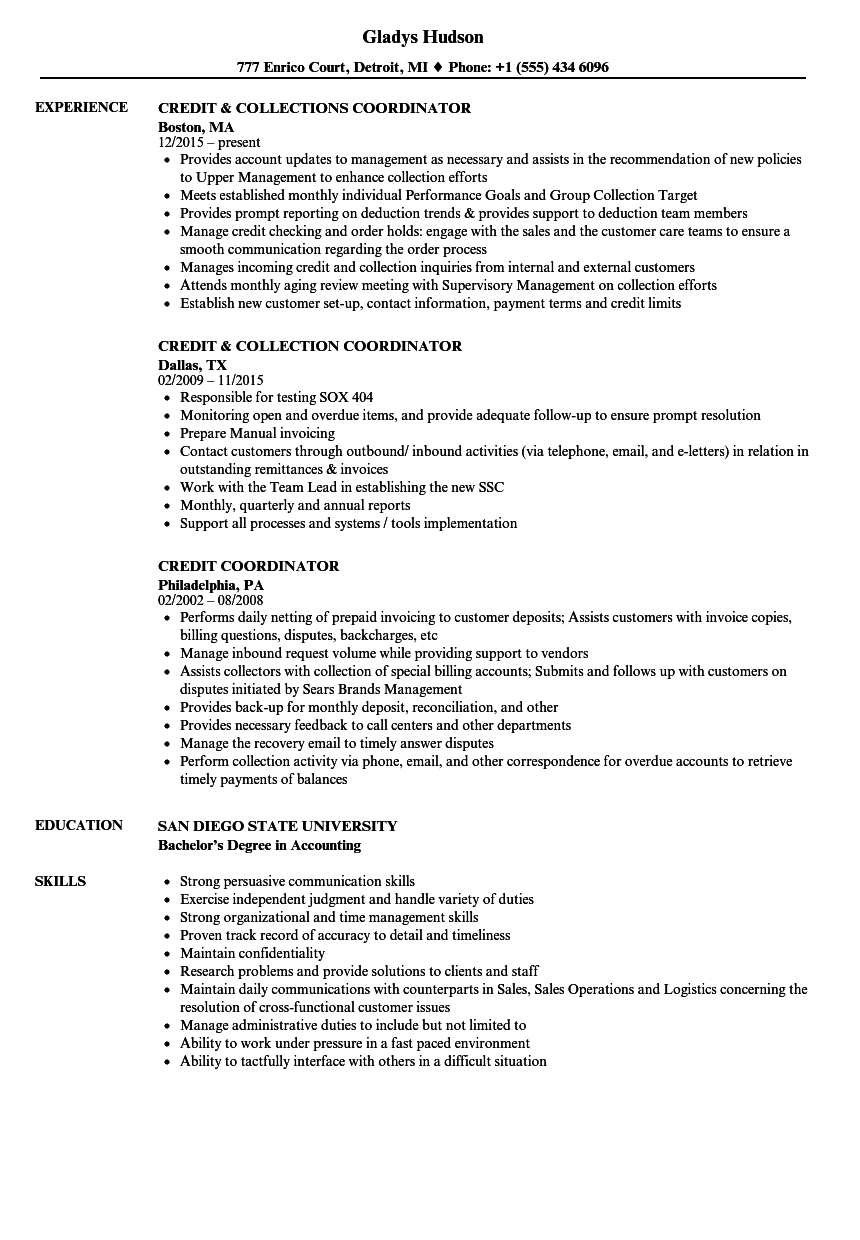

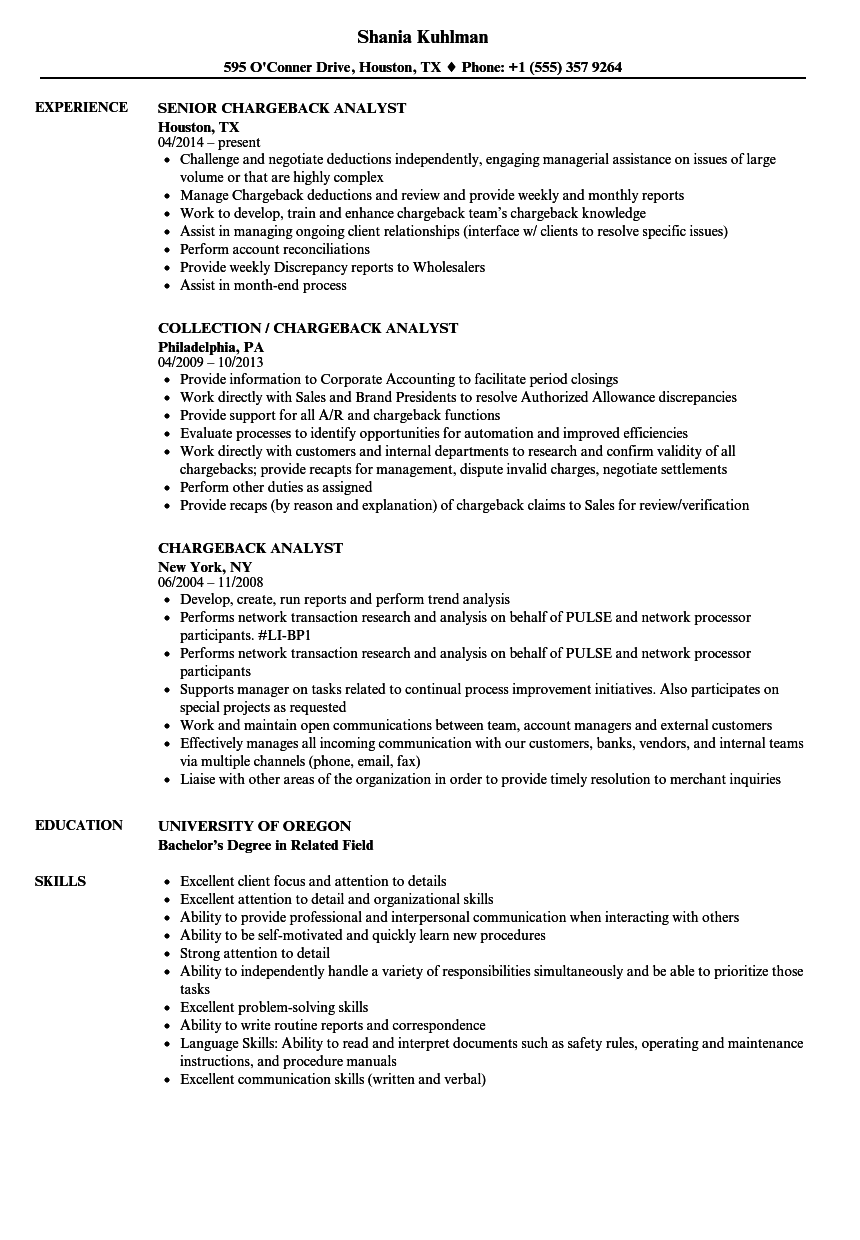

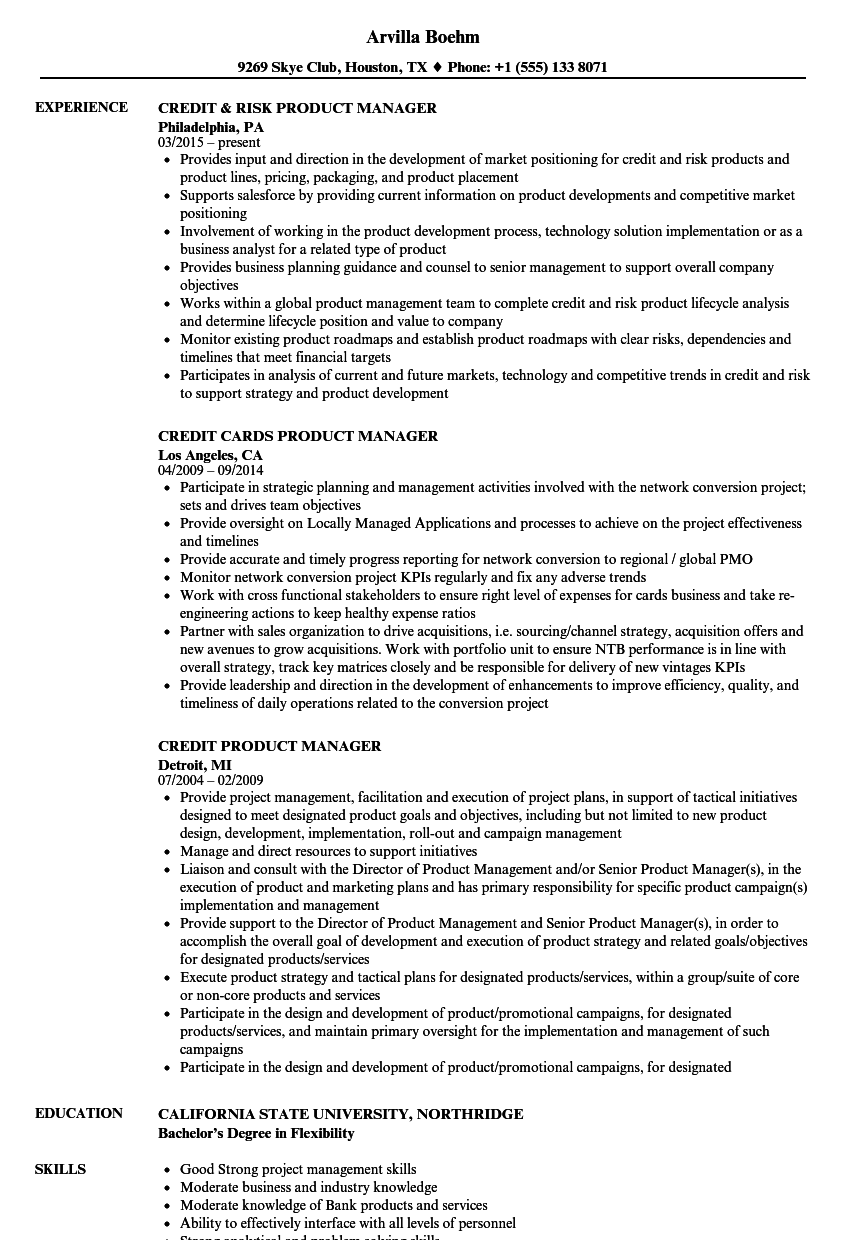

Credit card fraud analyst resume. Term sheets offer letters and new accounts including KYC client profile as required. Payment Analyst Resume Samples and examples of curated bullet points for your resume to help you get an interview. This needs to be done so the analyst can provide the correct evidence.

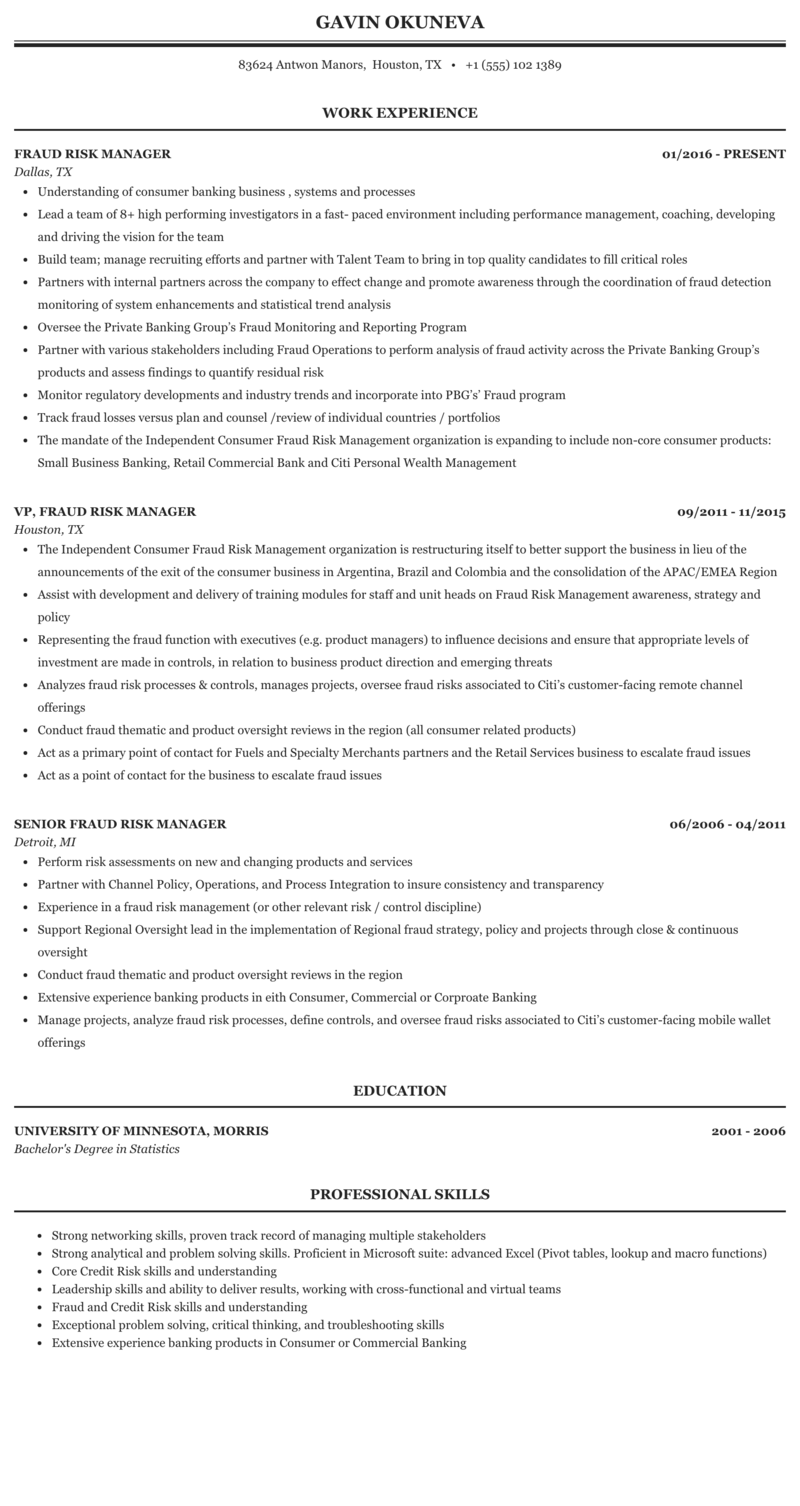

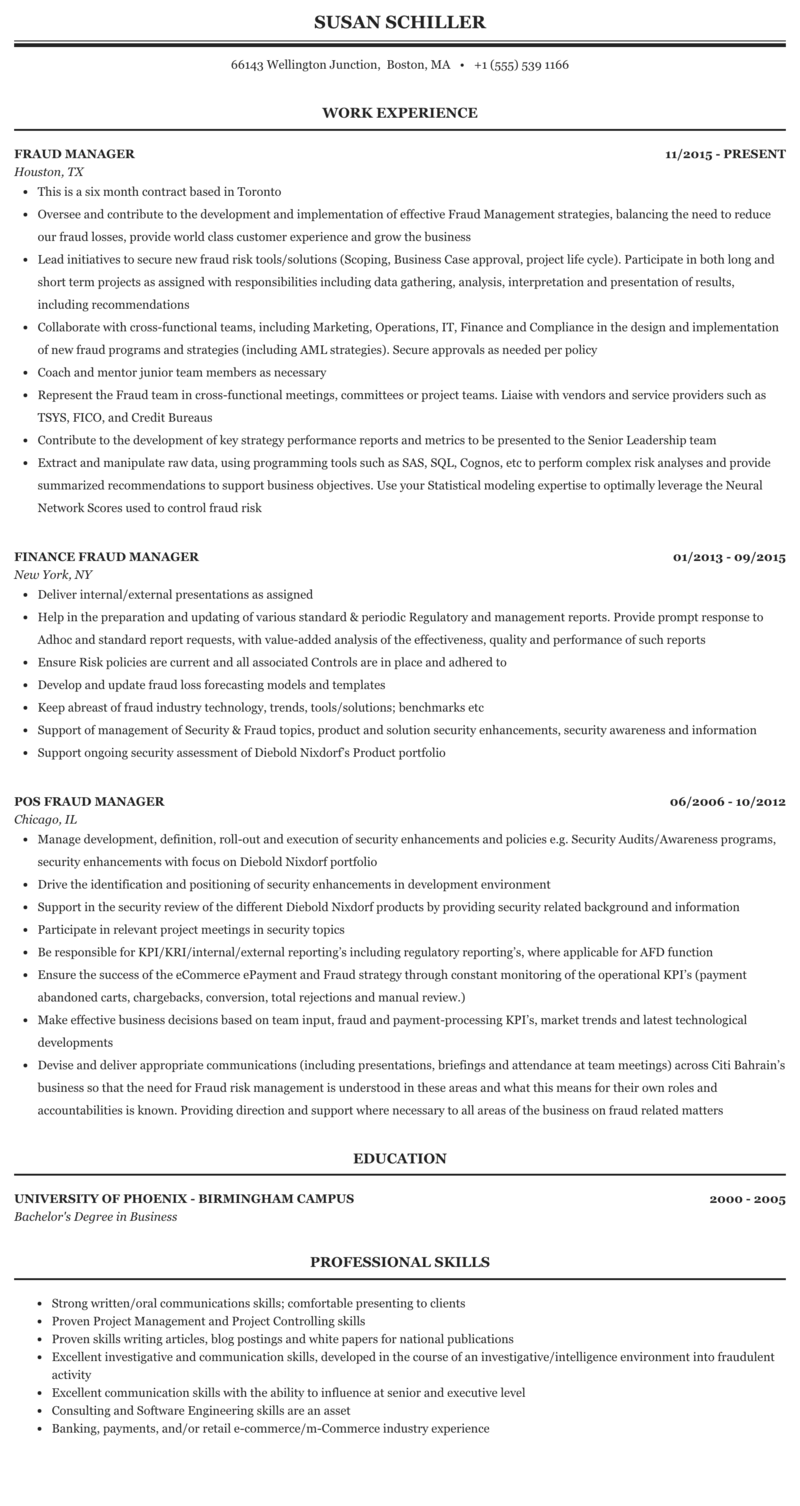

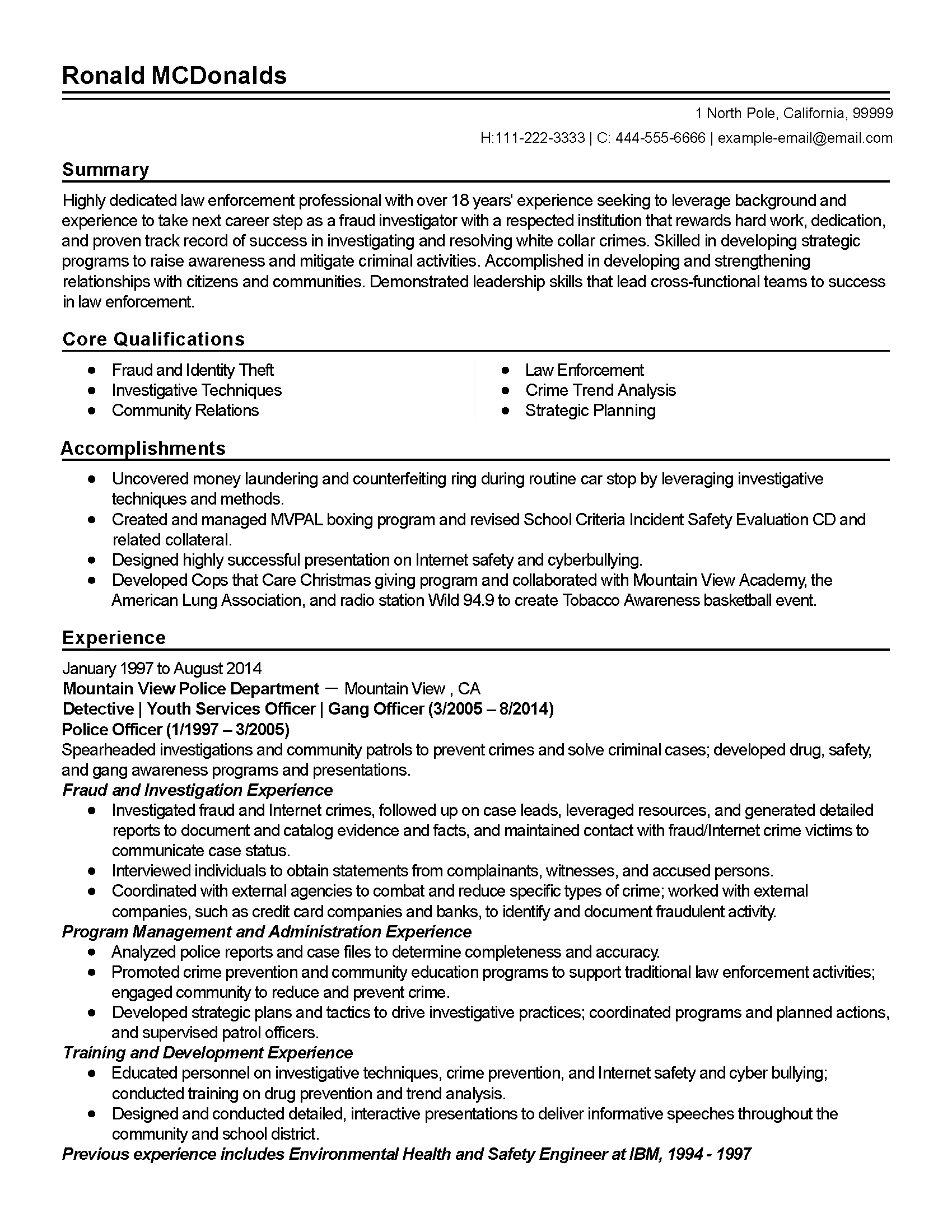

Quality-driven results-focused professional looking to obtain Customer Service Collections or Data Entry position. Being a Credit Card Fraud Analyst requires a high school diploma or its equivalent. Fraud Analyst Resume Examples Fraud Analysts investigate forgery and theft within a customers account as well as transactions conducted on behalf of a financial institution.

Analyse vendor account to maintain clear balances by clearing debitcredit removing blocks following up and solving issues etc Run daily and. Typically reports to a supervisor or manager. The applicant succinctly summarizes his strongest skills in a three-sentence paragraph.

Getting a fraud analyst resume right can sometimes be as forensic a process as detecting fraudulent activity. Credit Card Fraud Analyst monitors suspicious transaction activities and resolves fraudulent activities. Credit Card SpecialistCo-ordinator Resume.

As you look through the fraud analyst resume sample identify the qualities that make it a strong document. Monitors and maintains all fraud related processes and procedures. It is the responsibility of the fraud.

15 Essential Fraud Analyst Skills For Your Resume And Career. Credit Analyst Resume Examples Samples. The average Credit Card Fraud Analyst salary in the United States is 39326 as of July 28 2021 but the range typically falls between 34822 and 50190.